Bitcoin’s transaction fees

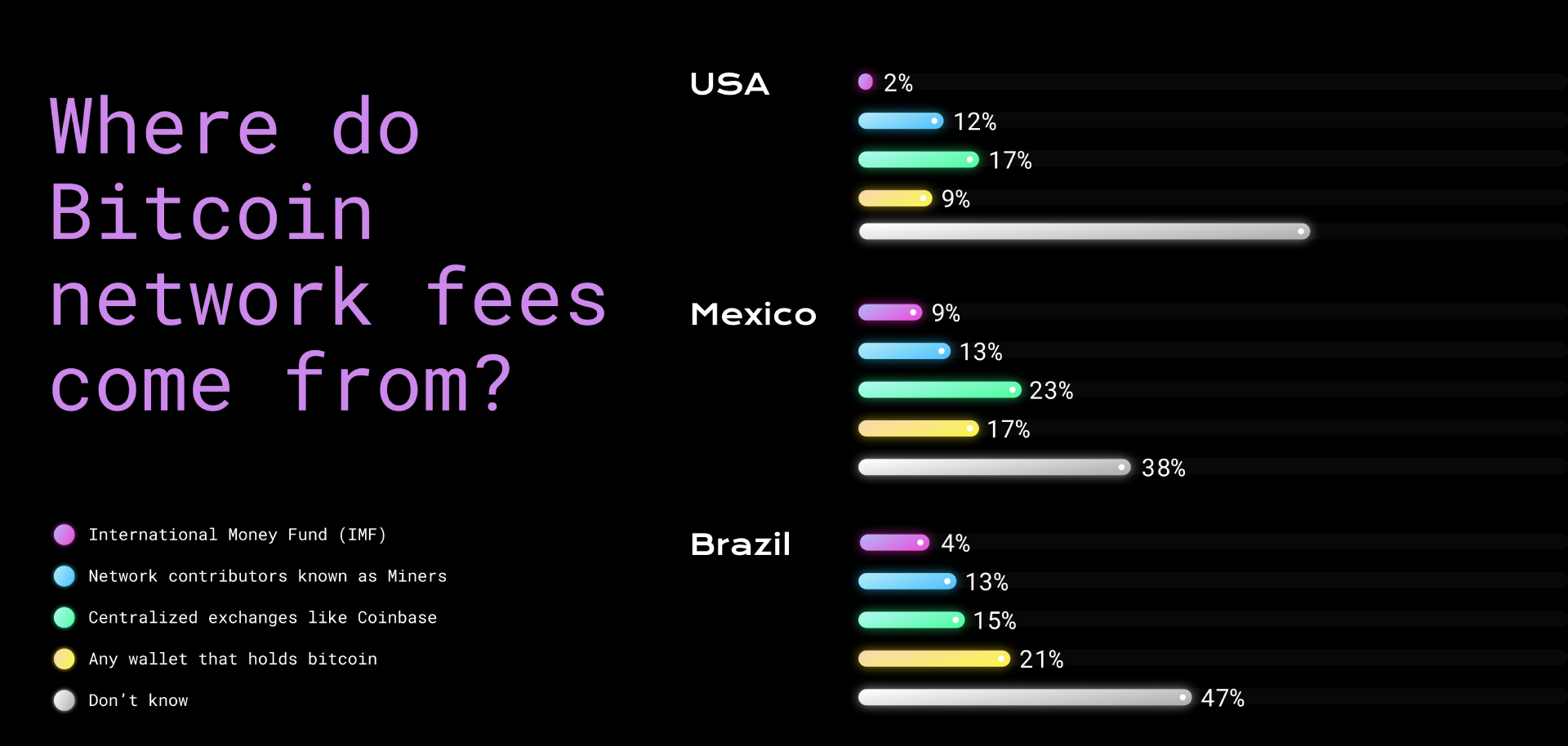

According to responses from the recent Global Crypto Literacy Survey, only 1 in 10 of the survey’s participants have clarity about how bitcoin transaction fees work.

Here are a few high level points about bitcoin transaction fees:

- Use of the bitcoin network does come with a cost, known as a transaction fee (more on these fees below)

- There is often a mix-up between actual bitcoin network fees and the fees that bitcoin services like centralized wallets and exchanges charge to use their products and services. Understanding the difference is important

- Bitcoin network fees are dynamic and change based on network use

We’ll take a deeper dive into some of these topics below.

Where do Bitcoin network fees come from?

An overview of bitcoin transaction fees

Since inception, bitcoin transaction fees have been an important part of how bitcoin works. In fact, transaction fees are a critical part of how a distributed, decentralized blockchain functions. One way to think about transaction fees is that they are like user fees that help maintain the infrastructure, so it can stay free of third-parties and gatekeepers.

Bitcoin transaction fees actually accomplish a few different objectives. First, the application of some kind of fee cuts down on network spam and unnecessary activity. Since each bitcoin block on the blockchain has a finite size, cutting down on spam and junk transactions helps the network’s overall efficiency.

Second, each transaction has to be validated to become part of the blockchain (the blockchain is just a string of validated transactions that are compartmentalized into blocks of data roughly every ten minutes). The more validated transactions, the more secure the blockchain becomes. So in some ways, transaction fees help with overall network security.

Third, and related to the point above, the validation and security function on-chain is carried out by bitcoin miners. Miners invest heavily in the computation needed in order for the blockchain to function and transaction fees along with block subsidies incentive miner participation.

Lastly, the block subsidy gets cut in half every four years, while mining becomes more difficult. But having transaction fees will help maintain the blockchain into the future. In a lot of ways, having transaction fees from the onset was a means to provide a mechanism for bitcoin’s survival well into the future — even after the block subsidies are depleted sometime in the next century.

Bitcoin transaction fees fluctuate

Today, the average bitcoin transaction fee is about $3.70, which is down significantly from a year ago. As the bitcoin network becomes more congested, meaning there are more people moving bitcoin on the network, fees will scale (because of the limited block size mentioned above). In 2017, at the height of the previous crypto boom, transaction fees topped out at an average of $60/transaction.

Also noteworthy is that not all bitcoin transactions have to be confirmed on the blockchain immediately. Some bitcoin wallets and services allow users to set transaction times and fee preferences (meaning if you can wait on a transaction to clear you can pay below average fees, but if you need it to clear quickly you can pay above average fees to have it prioritized). But, in reality, and for the sake of simplicity, most wallets just charge the average transaction fee and don’t give the user options.

Finally, it is really important to understand that bitcoin transaction fees and the service fees charged by most bitcoin service providers are not the same thing. Transaction fees support the bitcoin network, while individual service fees support the company providing the product or service. Most bitcoin companies do a good job of itemizing fees, but if you are not sure, ask.

Just remember, bitcoin fees equals freedom from third party services and gatekeepers.

Learn more about this and other topics by taking courses in the bitcoin, NFT, DeFi, and security sections of the site. And be sure to take the crypto literacy quiz.