Bitcoin’s fixed supply

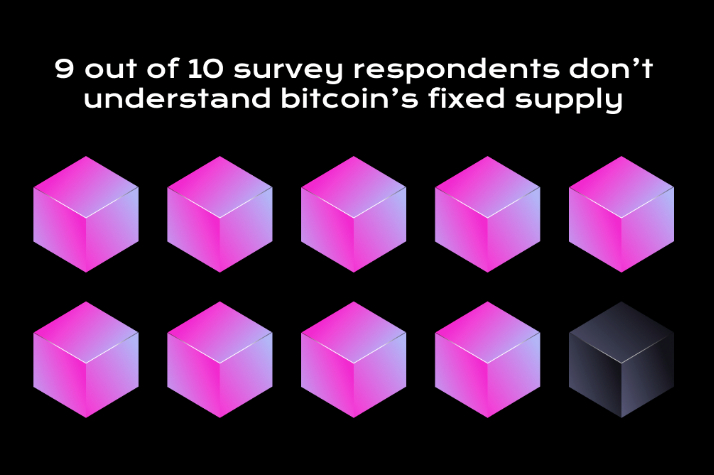

The results of the recent Crypto Literacy Survey show that 9 out of 10 respondents don’t understand the basics about bitcoin supply and demand.

But one of bitcoin’s greatest attributes — and one of the things that will drive the bitcoin price higher — is the currency’s value is its fixed supply. Understanding the law of supply and demand is intuitive: As something becomes more scarce, it’s value goes up. In economic systems, scarcity can be created in a few ways including having a limited supply, or having a high demand.

The thing about bitcoin is that it has both: A limited supply and an increasing demand. The result of these conditions is that the price of bitcoin continues to climb.

Two things to know about the bitcoin supply

Regarding bitcoin’s supply, there are two key things to know. The first is that bitcoin’s issuance is hard-coded in the protocol to stop at 21 million bitcoin. The second thing is that the creation of bitcoin will follow a schedule for the next 120 years. The last bitcoin of the 21 million bitcoin will be created sometime in 2140. Following that, the network will continue to be maintained and updated so all of bitcoin’s utility and functionality will exist, only that bitcoin will become extremely scarce.

21 million

A new trend at the world’s central banks that control the production and distribution of the world’s traditional fiat currencies is to print more money as needed. In the past few years, these on-demand money printing capabilities were used to stave off short-term financial downturns, potentially at the long term expense of the value of the money supply.

Meanwhile, bitcoin’s governing architecture is designed to stop minting new bitcoin once the total supply hits 21 million. This means that people can invest in bitcoin and know what the supply and economics will look like in the future. Many proponents of bitcoin call it a “hard asset” in that the well-defined aspects of the network make its currency valuable. Unlike fiat money, which is not well-defined and has an unknown supply.

The continual money printing by central banks and fiat currency systems is inflationary. As the supply of the money increases and demand can’t keep pace, then the purchasing power of the underlying currency starts to erode. Meanwhile, bitcoin is deflationary, meaning as time goes on and bitcoin continues to be produced, and demand increases, then the value of an individual bitcoin will continue to rise.

Schedule and halvings

Another important thing about bitcoin issuance and supply is that it follows a set schedule. Unlike central banks that continually change policies that affect the money supply and the speed at which money moves around the economy, bitcoin’s schedule is already mapped out well into the future.

A new bitcoin block is mined roughly every ten minutes. Each block on the Bitcoin network contains confirmed transaction data (the elegance of bitcoin is that these transaction details can be verified without the need for a bank or payment processor). The confirmation process happens through intensive computation called mining. Each time a block is mined, one of many competing miners gets a block reward, which incentivizes the whole system of maintenance and upkeep and also means that new bitcoin is created at regular intervals.

The last thing to know about the production of bitcoin is that roughly every four years, the bitcoin mining reward gets cut in half. Before the last halving, which happened on May 11, 2020, the bitcoin block reward was 12.5 bitcoin for every block successfully mined. Right now, the block reward is 6.25 bitcoin per successful block. In the spring of 2024, following the next halving, the block reward will be 3.125. This schedule of halving events continues every four years until the last bitcoin is mined. So far, following every halving event, the price of bitcoin has gone up significantly.

Looking to learn more about bitcoin and cryptocurrencies? Be sure to take the crypto quiz and/or take a course on bitcoin, DeFi, NFTs, and security.