Summary

Cryptocurrency and blockchain can be hard to understand because they are actually many interwoven underlying ideas and technologies. One way of mapping cryptocurrencies is to remember that they can almost always be broken down into two big categories: the money layer and the application layer.

Trying to come up with a perfect definition of cryptocurrencies is a pursuit of the elusive. Cryptocurrencies are hard to define because many things are lumped together and flown under the same banner — often reduced to “blockchain technology.”

Grabbing hold of a complete and deep understanding of all things crypto is always just out of grasp because crypto is the perfect combo of two already complicated subjects: technology and finance.

Crypto is even more complex than traditional technology or traditional finance. This complexity is because we don’t have much experience with crypto fundamentals, such as open-source protocols, digital peer-to-peer and property rights, and public ledgers and private keys, among other things.

In addition to these unique attributes, is an industry moving at breakneck speed. Cryptocurrency markets, which trade across the entire planet (and beyond), never close. Moreover, unlike traditional markets, crypto trades through weekends and holidays, 24 hours a day, seven days a week.

The market is always open, and new assets are constantly added. And new crypto products and services continue to launch in regular waves — like DeFi savings and lending, NFTs, Web3, and more.

Against constant innovation, service, and product evolution, it’s easy to lose your bearings and find the emerging industry confusing or overwhelming.

One way of mapping cryptocurrencies is to remember that they can almost always be broken down into two big categories: the money layer and the application layer:

- The money layer brings utilities like digital stablecoins, digital stores of value, and universal availability.

- At the application layer, cryptocurrencies enable the creation of code-based financial and digital services that increase accessibility and inclusion.

With all the complexity distilled down, cryptocurrencies and digital assets are growing in size and scale so much that they are presenting real alternatives to traditional investments, markets, and financial products.

The most impactful innovations or technologies come along when the timing is right. The rise of crypto has as much to do with the availability of new tech as it does with the state of global geopolitics and macroeconomics.

Crypto exists because of an underlying need, desire, and market opportunity for internet-based, digitally native, alternative financial systems.

Having alternatives is particularly important as the world enters a time of economic uncertainty and upheaval following years of rampant money printing and financial tinkering by central banks.

The money layer

One of the most significant innovations made possible by cryptocurrencies is the idea of digital money. However, it goes beyond currency to enable entire code-based economic systems governed by users and network members.

Bitcoin’s pseudonymous creator, Satoshi Nakamoto, first outlined bitcoin’s design as a peer-to-peer form of digital cash in the 2009 Bitcoin Whitepaper. It’s a document outlining a single cryptocurrency as much as it acts as a manifesto for the entire crypto industry it inspired.

As cryptocurrencies gain more traction and market capitalization, some major themes define the crypto space, including:

- The need for sound money systems for financial freedom: Money needs to be easy to use and equally accessible to all. Permissionless money (meaning anyone can participate) is code-based and free from bias, censorship, and authoritarian control. It is made possible by cryptocurrency/blockchain-based systems

- The future of money is frictionless: Moving money, everything from micropayments to cross-border payments, still takes a lot of time and resources, mainly because of the interoperability and intermediaries needed for a transaction. Today, even seemingly simple things like credit card transactions are amazingly complex, resulting in fees for merchants and businesses. Making money frictionless and transactions as simple as possible will have downstream impacts, such as more affordable commerce and business development at all scales.

- Code-based money helps reduce the politics and the nation-state politics of money: When money is weaponized as a means of control, it disproportionately affects the most vulnerable — and the people with the least control. Although crypto systems have their governance flaws, a fully mature, widely adopted cryptocurrency-based financial system, complete with globally available competing alternatives, reduces the ability of governments and authorities to tinker with money supplies or use the money for political advantage.

The interesting thing about all the emerging cryptocurrencies is they each have a different spin or take on how to achieve the vision of code-based money best.

Whether the underlying crypto system is designed for advanced financial trading leveraging artificial intelligence and machine learning or whether the crypto system is designed to be a fixed-value digital representation of a real-world currency or commodity (like stablecoins), one thread that weaves all of these new digital assets together is that they are designed to help move beyond the analog traditional financial system.

The application layer

Cryptocurrencies can function like a kind of internet application layer with value, a user incentive structure (not based on advertising or surveillance), and network maintenance with built-in upkeep fees. It is the synergistic comb of economic activity plus internet network architecture that makes cryptocurrency systems so valuable.

Smart contracts are one of the most popular ways to build application functionality on top of blockchain networks to leverage established networks’ total security and utility.

So far, Ethereum is the most widely adopted and well-known smart contract platform. In 2015, Ethereum was created as a hub for several waves of smart contract-based innovation. It now includes massive sub-categories within crypto, such as the following:

- Decentralized finance or DeFi: So far, DeFi broadly refers to banking and trading-like services built on protocols like Ethereum rather than built out as traditional financial institutions. One advantage of DeFi is that its new products and services are accessible and can be tailored to specific market needs. The downside is that DeFi is an unregulated space and frontier tech is still prone to things like hacks or implosions.

- Non-fungible tokens or NFTs: NFTs are a new kind of token standard that leverages an underlying protocol to create a unique asset for each instance of a digital product or artifact. So far, NFTs are popular in the art and collectible space. Still, over time it’s easy to see how the ability to connect custody or ownership to unique and secure digital records (that can be vetted publically) will impact all kinds of functions and industries.

- Interactive gaming/metaverse: One of the most significant attributes of cryptocurrency systems is that they are digitally native. As more and more of our lives become digital or have digital expressions, it makes sense that digital currencies will thrive in digital-only worlds. The use of specially-designed tokens and NFTs are already happening in interactive games and metaverse platforms.

The examples above are just a tiny sample of how we can leverage cryptocurrencies to create new kinds of products and services.

A little over ten years ago, there were just a handful of cryptocurrencies to navigate around, and they were all more or less trying to solve the same problem. Today, there are more than 19,000 different kinds of cryptocurrencies. The issues they are trying to solve range from building sound money systems to fighting climate change to better protecting digital identity.

Adoption rates

The story of global crypto adoption is like a tug-of-war between short-term market moves and longer-term trends of new asset launches, applications, products, or services, and overall adoption trends.

Crypto has pronounced ups and downs, or bull and bear markets. Along the way, major players in the crypto markets, such as exchanges and protocols, have also experienced events — like hacks, bankruptcies, and investigations — which have created short-term pullbacks or downside volatility.

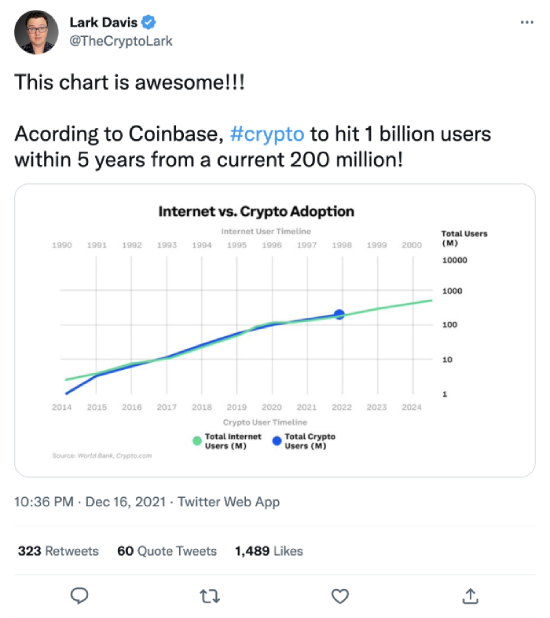

However, when we zoom out beyond the news cycles and quarterly earnings reports, it is clear that the adoption of cryptocurrencies is happening at a genuine and sustained pace. In fact, according to overall adoption data, cryptocurrencies are on pace with the general trend of internet adoption.

What’s next?

If there is one thing we know for sure, the crypto industry will not stand still for long. Whether the market is going to go up tomorrow or down next week, no one knows for sure. But we know the market will continue to mature, evolve, and become a more extensive alternative to traditional financial markets.

We also know that the crypto space will continue to be innovative, and new financial products and services will become available. Web3 will be a new, massive frontier that will make the internet better, more secure, and more user-centric.

Along the way, we will also see additional development of money-based cryptocurrency systems like stablecoins, decentralized finance (DeFi), and non-fungible tokens (NFTs). And we will also see new kinds of crypto applications and the development of new digital products and services for things like immersive gaming and the metaverse.

While the future is uncertain, cryptocurrencies and digital ledger technologies will play a role in what’s ahead. And while these new technologies might feel abstract or fuzzy, the best way to figure them out is to dive right in — and we hope the content and learning resources forthcoming during Crypto Literacy Month will help.

To assess your crypto knowledge, take the quiz at CryptoLiteracy.org/quiz and access courses curated by CoinDesk to bridge your knowledge gaps.