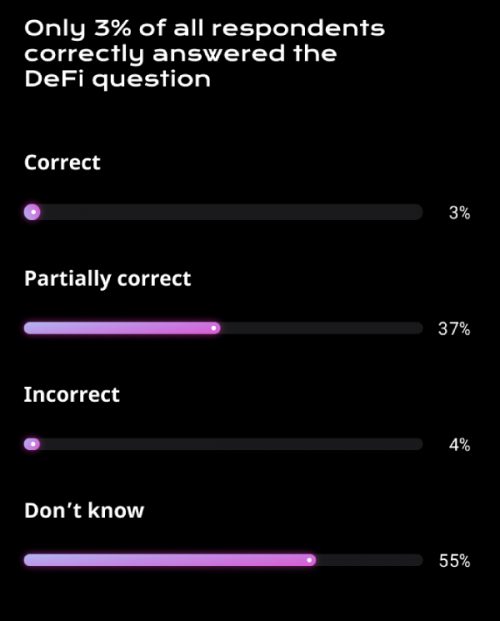

DeFi is still fuzzy

According to the results from the recent Global Crypto Literacy Survey, only three percent of respondents could answer a question defining decentralized finance, or DeFi. Of the respondents, more than half (55 percent) didn’t even have enough context to formulate a DeFi definition.

The term decentralized finance was first used in 2018 by people that were envisioning and redesigning the way the global financial system works and it broadly applies to financial systems and services built on blockchain and leveraging the potential of cryptocurrencies. DeFi has a quickly evolving set of participation and governance guidelines that are designed to make financial services more like networks that become more valuable and robust the more users and investment there is.

So what is DeFi?

The general objective of DeFi is to replace human-controlled institutions, organizations, and bureaucracies with software and computer code. The idea is that code-based systems that are outside the control of politics, bias, and legacy power structures, will be more efficient, more practical, and more accessible than the traditional financial system.

Put simply, the builders of DeFi systems want to do to financial products and services what the internet did to mainstream media. Instead of single points of failure, legacy gatekeepers, and middlemen, DeFi is built on a system where users of financial networks and products get to have a say in how services they use are built and maintained.

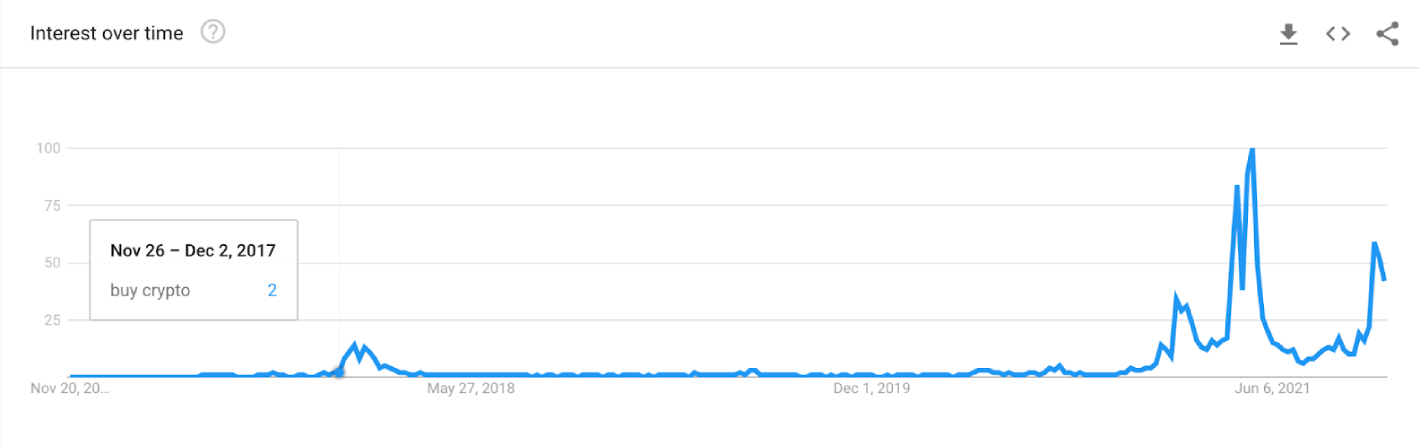

DeFi systems are public, in that they are blockchain-based and provide a record of transactions, activity, and ownership. Users can participate in DeFi networks by buying, borrowing, lending, and staking tokens native to a DeFi network. So far, billions of dollars are already locked up in DeFi networks, with overall investment in the space growing rapidly.

Most DeFi systems are built on blockchains that support “smart contracts” which is a system of creating and writing code-based rules on which decentralized applications are built. Entire organizations can be created using smart contracts, culminating in something called a decentralized autonomous organization, or a DAO.

One of the main components of decentralization and DeFi is how groups of people will organize and govern themselves. Early DeFi systems are proving interesting in this regard because users can help systems make decisions about governance by buying, selling, and staking tokens.

Learn more about this and other topics by taking courses in the bitcoin, NFT, DeFi, and security sections of the site. And be sure to take the crypto literacy quiz.